- #Quickbooks pro with payroll 2016 online how to#

- #Quickbooks pro with payroll 2016 online software#

- #Quickbooks pro with payroll 2016 online free#

Tax accuracy guarantee: Like most payroll software solutions, Intuit guarantees that employee paychecks will be processed accurately an on-time. Intuit will notify you when W-2s and 1099 forms are due and can process those forms on your behalf. Process W-2s and 1099 forms: The IRS requires a number of forms from your business.

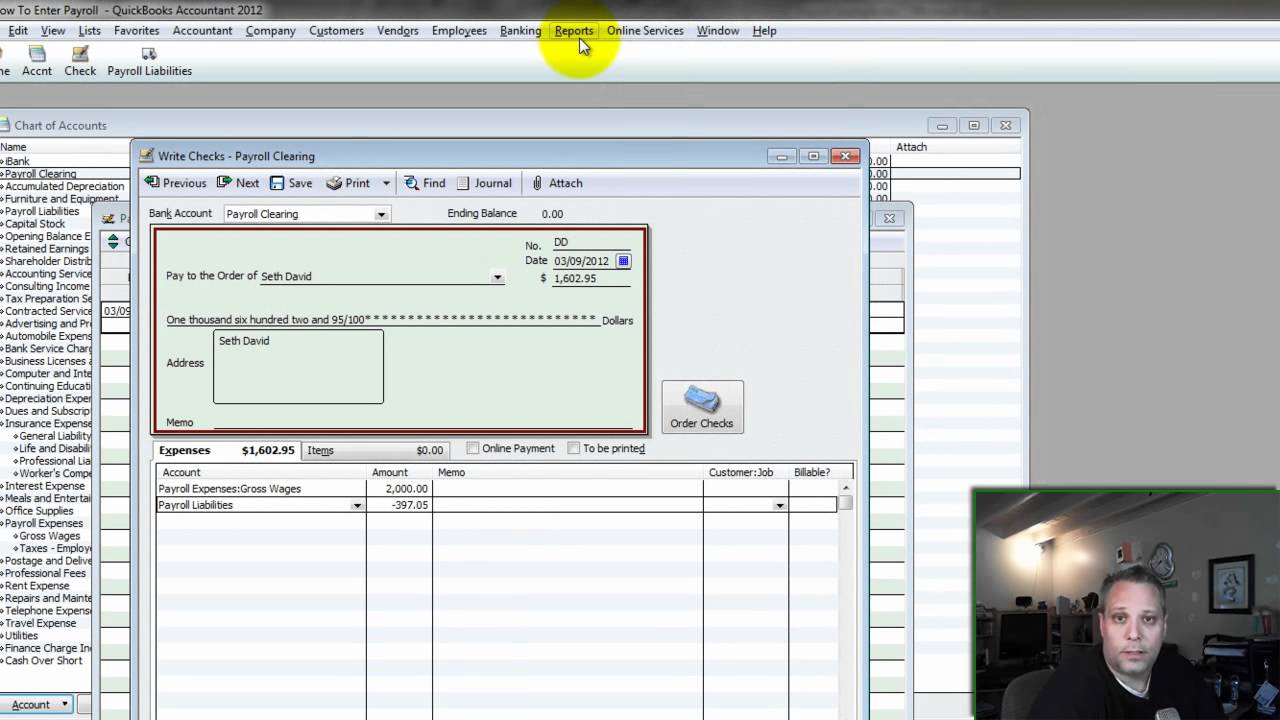

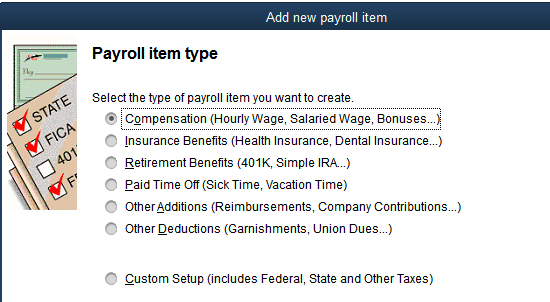

Employers can also create more deductions based on 401(k), stock purchasing plans, and other company-specific policies. You can pay employees via direct deposit or print checks directly from your office printer.Īssess deductions: Payroll taxes are automatically deducted from employee paychecks according to state and federal law. Pay employees: After creating employee paychecks and assessing deductions, Intuit lets you send out payments. You can pay hourly employees, salary employees, and contract employees in just a few simple clicks. Here are the ways in which Intuit Online Payroll will help your business:Ĭreate accurate paychecks for employees: Intuit Online Payroll lets you accurately pay employees. However, even if your business already uses payroll software, Intuit’s easy online system may still save time and enhance the accuracy of your business’s payroll system. Most businesses already use payroll software. With Intuit Online Payroll, employers can easily pay employees while accurately deducting payroll taxes and other deductions. Intuit Online Payroll is a simple but effective payroll software solution.

#Quickbooks pro with payroll 2016 online free#

If you need payroll software, Intuit Enhanced Payroll is exactly what you need. Intuit also offers a 30 day free trial and its only $2/ per additional employee. QuickBooks helps manage the accounting and bookkeeping aspects of your business while Intuit Online Payroll lets you accurately pay employees and assess payroll taxes. Intuit Online Payroll and QuickBooks help your business in different ways. Intuit Online Payroll vs QuickBooks Online How They Help Your Business

#Quickbooks pro with payroll 2016 online how to#

Find out how to get free payroll software here for 30 days. The two payroll software programs work best in complementary roles and are a popular combo for small and medium-sized business owners across the country. While Intuit Online Payroll manages the payroll side of your business, QuickBooks handles basic accounting functions. However, each service helps your business in a different way. Intuit Online Payroll and QuickBooks are two useful business management services.

0 kommentar(er)

0 kommentar(er)